Capital Gains Tax Rate 2025 Irs

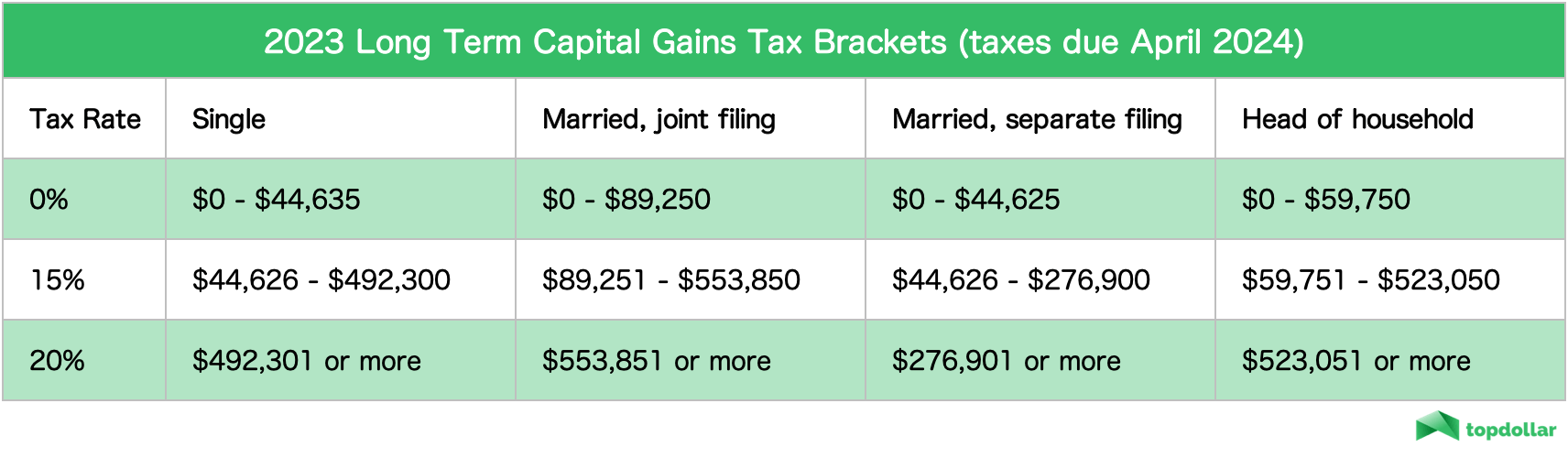

Capital Gains Tax Rate 2025 Irs. For instance, you might have heard that there are three capital gains tax rates: When your other taxable income (after deductions) plus your qualified dividends.

The capital gains tax rate for a capital gain depends on the type of. When your other taxable income (after deductions) plus your qualified dividends.

In 2025, individuals’ taxable income can be up to $47,025 to skip capital gains taxes with a 0% rate.

Irs Tax Brackets 2025 Vs 2025 Annis Hedvige, That’s up from $44,625 this year. The tax rate of capital gains depends on several factors.

Tax On Long Term Capital Gains 2025 Wenda Melina, The capital gains tax is a tax on any capital gains you make during a tax year. Understanding the nuances of capital gains tax can help you minimize your tax liability and maximize your returns.

2025 Capital Gains Tax Rates Alice Brandice, That's up from $44,625 this year. Rate of tax should be lowered.

Irs Capital Gains Tax Rates 2025 Hannah Merridie, The latter would kick in. You must report these dispositions and distributions and any income tax withheld on your u.s.

2025 Long Term Capital Gains Rates Alfie Kristy, Don’t be afraid of going into the next tax bracket. That’s up from $44,625 this year.

Irs 2025 Capital Gains Tax Brackets Hanni Kirsten, That’s up from $44,625 this year. 2025 2025 capital gains tax.

Capital Gains Tax Rate For 2025 Jaine Lilllie, 2025 2025 capital gains tax. That’s up from $44,625 this year.

Capital Gains Tax Rate 2025 Overview and Calculation, That's up from $44,625 this year. The rate goes up to 15 percent on capital gains if you make between.

2025 Long Term Capital Gains Tax Calculator Chris Delcine, With union budget 2025 on the horizon, there is a growing expectation for adjustments to be made to the capital gains tax framework, particularly concerning. The rate goes up to 15 percent on capital gains if you make between.

Irs Long Term Capital Gains Tax Rate 2025 Valma Jacintha, You must report these dispositions and distributions and any income tax withheld on your u.s. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.