Best Target Date Funds For 2045

With enthusiasm, let’s navigate through the intriguing topic related to Best Target Date Funds for 2045. Let’s weave interesting information and offer fresh perspectives to the readers.

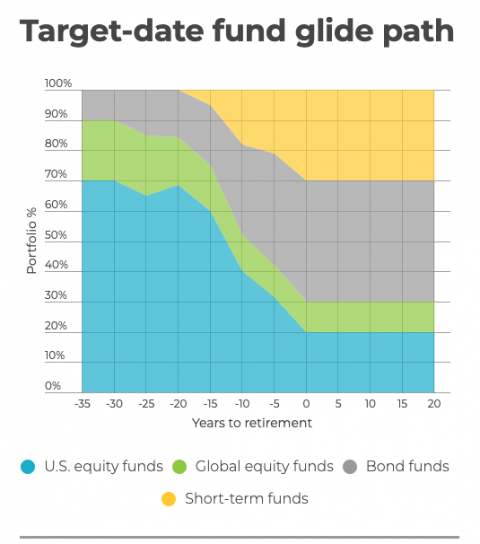

Target date funds are a type of mutual fund that automatically adjusts its asset allocation based on the investor’s expected retirement date. As the investor nears retirement, the fund gradually shifts from growth-oriented investments to more conservative ones, such as bonds. This helps to reduce risk and protect the investor’s savings.

Target date funds are a popular choice for retirement savings because they offer a simple and convenient way to invest for retirement. Investors only need to choose a fund with a target date that is close to their expected retirement year. The fund will then handle the rest, automatically adjusting the asset allocation and rebalancing the portfolio as needed.

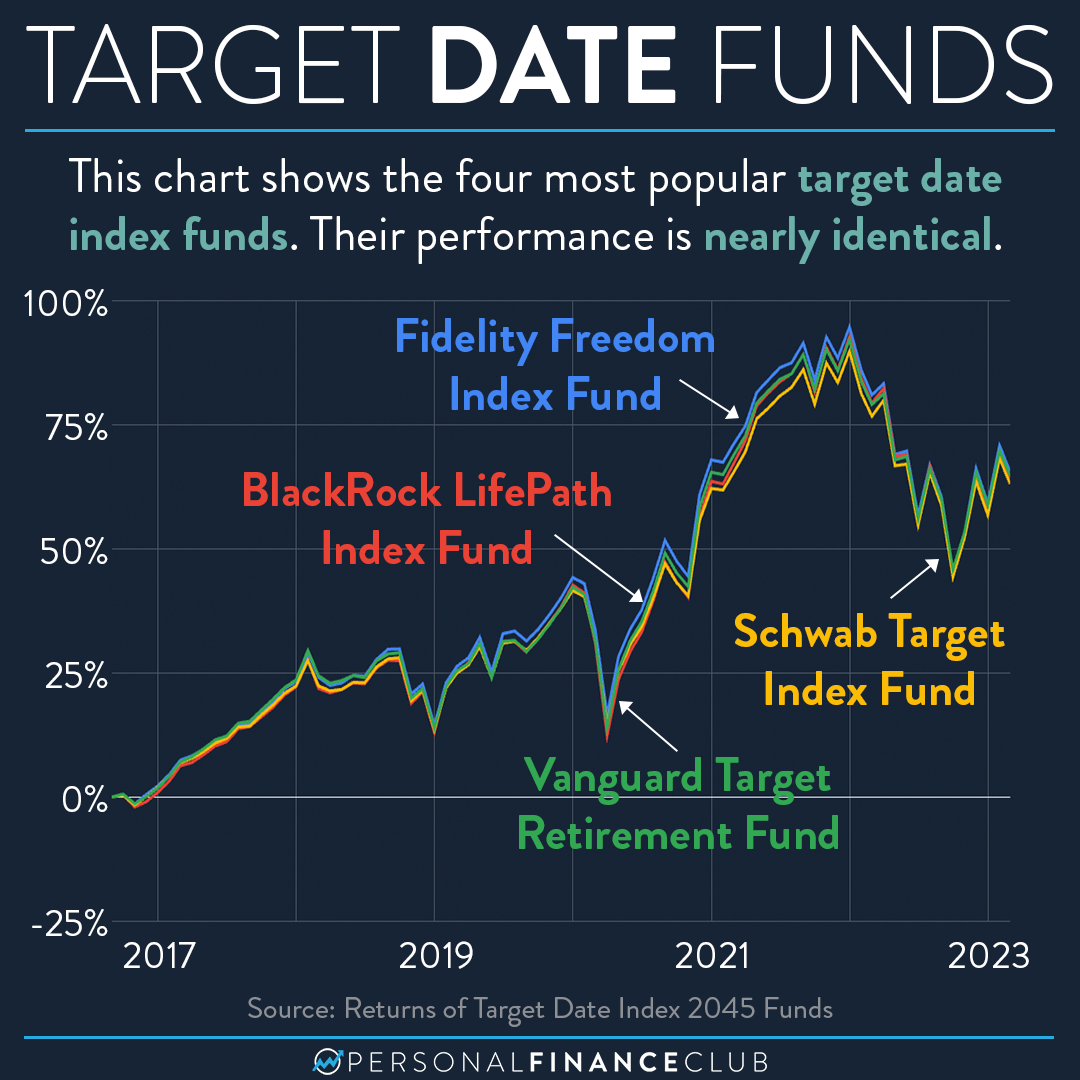

There are many different target date funds available, so it is important to compare the different options before choosing one. Some of the factors to consider include the fund’s expense ratio, investment strategy, and historical performance.

These funds all have low expense ratios, solid investment strategies, and a history of strong performance. They are a good choice for investors who are looking for a simple and convenient way to save for retirement.

Target date funds are one of many different retirement savings options available to investors. Other options include traditional IRAs, Roth IRAs, and 401(k) plans.

Target date funds offer a number of advantages over other retirement savings options, including simplicity, diversification, and automatic rebalancing. However, target date funds also have some disadvantages, such as higher expense ratios and less flexibility.

Investors should carefully consider the pros and cons of target date funds before deciding if they are the right choice for them.

Thus, we hope this article has provided valuable insights into Best Target Date Funds for 2045. We appreciate your attention to our article. See you in our next article!